Current Affairs is the most important area in all competitive exams. But the difficulty level is very high. That’s why; many aspirants get confused, how to select Current Affairs for Preparation of Competitive Examination? In this Post, Daily Current Affairs 9 September 2022, we have tried to cover each and every point and also included all important facts from National/ International news that are useful for upcoming competitive examinations such as UPSC, SSC, Railway, State Govt. etc.

Current Affairs for Competitive Exam – 9 September 2022

Google Cloud partners with HDFC ERGO to digitise insurance buying in India

Google Cloud partners with HDFC ERGO to digitise insurance buying in India: HDFC ERGO General Insurance, one of India’s leading insurance companies, announced it is partnering with Google Cloud to create a technology platform that will help digitize insurance purchasing and service in the country. Cloud computing division of Google has been partnered with HDFC ERGO General Insurance to build a platform that will help digitize the buying and servicing of insurance in India.

September 2022 Current Affairs Quiz

HDFC ERGO will launch innovative insurance products. HDFC ERGO aims to fully migrate to the cloud by 2024. At present, nearly 93% of its retail policies are issued digitally and almost 40% of its customer requests are serviced virtually.

Karnataka Bank becomes part of Khajane II IFMS

Karnataka Bank becomes part of Khajane II IFMS: Karnataka Bank has now become the participant of the Treasury Department’s Khajane-II (K2) integrated financial management system (IFMS).

September 2022 Current Affairs Quiz

Reason: For implementing the Single Nodal Agency (SNA) account system for Centrally Sponsored Schemes (CSS).

The bank will continue to engage and cooperate with the Government of Karnataka in implementing its numerous efforts to benefit the people through its technology and digital-led solutions.

Reliance General Insurance, Policybazaar launch Reliance Health Gain Policy

Reliance General Insurance, Policybazaar launch Reliance Health Gain Policy: Reliance General Insurance and Policybazaar have jointly launched Reliance Health Gain Policy. The company looks optimistic with the launch as one of its officials said that offering Reliance Health Gain Policy on Policybazaar will enable us to make our most flexible health insurance product accessible to a larger population and present them with the freedom of choice.

September 2022 Current Affairs Quiz

This policy gives its customers the freedom to choose and personalise their health policies as per their requirements. To make accessible to all, the product is being live on digital distribution channel, Policybazaar. This policy is available in – Plus, Power and Prime. This plan will cater to the needs of a small family of 2 as well as a larger one of 12.

IDFC FIRST Bank joins the Open Network for Digital Commerce (ONDC)

IDFC FIRST Bank joins the Open Network for Digital Commerce: IDFC First Bank has signed up as participant in the Open Network for Digital Commerce (ONDC), an initiative of ministry of commerce and industry.

September 2022 Current Affairs Quiz

The bank has enabled a platform for buyers, that help them to discover sellers in the ONDC network. The bank has started onboarding small merchants, who are its current account customers, on to a partner app registered with ONDC. The app is expected to help small merchants carry out transactions over ONDC’s electronic network.

ESAF Bank launches ‘rainbow account’ for transgender community

ESAF Bank launches ‘rainbow account’ for transgender community: ESAF Small Finance Bank Ltd has launched a ‘Rainbow Savings Account’ for the transgender community. This bank account offer a host of features, including high savings rate and advanced debit card facilities.

September 2022 Current Affairs Quiz

In 2015, the Reserve Bank of India has directed banks to include a separate column ‘third gender’ in all their forms and applications. The savings habit of the marginalised community will contribute heavily to the growth of the economy as a whole.

Ombudsman disposed of 32% more complaints against insurers in 2021-22

Ombudsman disposed of 32% more complaints against insurers in 2021-22: The Insurance ombudsman has disposed of 40,527 complaints against insurance firms across the country during 2021-22 as compared with 30,596 in 2020-21. The complaints relating to health insurance made up a third of the total number cases disposed of by ombudsmen in 2020-21.

September 2022 Current Affairs Quiz

Ombudsman:

- An alternative mode of settling insurance disputes.

- It was constituted under rules framed by the finance ministry in 2017.

- At present, 17 Insurance Ombudsman in different locations.

RBI selected Precision and HDFC Bank for retail payments test phase

RBI selected Precision and HDFC Bank for retail payments test phase: RBI has selected HDFC Bank and Precision Biometric India for testing their ‘on tap’ retail payments applications under the regulatory sandbox scheme.

September 2022 Current Affairs Quiz

Regulatory sandbox:

It refers to live testing of new products or services in a controlled/test regulatory environment. For this regulators permit certain relaxations for the limited purpose of the testing. It allows the regulator, innovators, financial service providers and customers to conduct field tests.

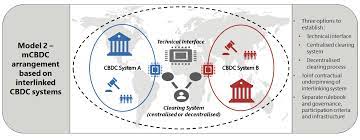

Digital currency to reduce time, cost for cross-border transactions

Digital currency to reduce time, cost for cross-border transactions: RBI Deputy Governor, T Rabi Sankar has announced that, government will launch Central bank digital currency (CBDC) by the end of 2022.

September 2022 Current Affairs Quiz

The RBI will launch digital currency on a pilot basis in 2022. In Budget for 2022-23, the finance minister had said the RBI would roll out a digital equivalent to the rupee.

Benefit: CBDC could become a tool for reducing time and cost for cross-border transactions.

Data Security Issue: They are keep working on it on a continuous basis.

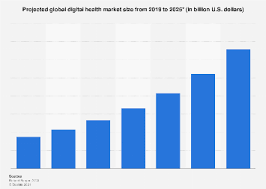

Healthcare sector in India will grow to USD 50 billion by 2025

Healthcare sector in India will grow to USD 50 billion by 2025: While addressing the 14th CII Global MedTech Summit, Science and Technology Minister, Dr Jitendra Singh has announced that Healthcare sector in India is expected grow to 50 billion dollar by 2025.

September 2022 Current Affairs Quiz

India aims to achieve 10 to 12% of the global market share of the medical devices sector. The Indian healthcare system has become more focused on innovation and technology. The govt also aiming to increase their investment in digital healthcare tools in coming five years.

DRDO and Indian Army successfully conducted six flight-tests of QRSAM

DRDO and Indian Army successfully conducted six flight-tests of QRSAM: DRDO and Indian Army have successfully conducted six flight-tests of Quick Reaction Surface to Air Missile (QRSAM) system from Integrated Test Range, Chandipur off the Odisha coast.

September 2022 Current Affairs Quiz

Aim: To check the pin-point accuracy of the weapon system with state-of-the-art guidance and control algorithms

QRSAM:

- It is a canister-based system.

- It is stored and operated from specially designed compartments.

- Range: 30 km (short-range SAM)

- Altitude: up to 10 km

UPI transactions reached 657 Crore in August 2022

UPI transactions hit record 657 crore in August 2022: The Unified Payments Interface (UPI) has recorded 657 crore transactions in August 2022, a 5% month-on-month growth compared to the previous month.

September 2022 Current Affairs Quiz

The transaction volume has crossed Rs 10.72 lakh crore in August. In July 2022, the UPI transactions breached the level of 600 crore.

The growth in UPI volumes by nearly 100% year-on-year (YoY) and amounts transacted growing by 75% YoY. NPCI also aims to process 1 billion transactions per day in the next few years.