RBI: Number of micro ATMs increases in 2022- According to data, released by the RBI, as of December 2022, the total number of micro ATMs across the country has reached 14.19 lakh.

But, there has been no significant surge in the value of money withdrawn through these devices since June 2022. There were just about 3.56 lakh micro ATMs in India in 2020. The cash withdrawal in Dec 2021 was ₹25.2-lakh crore.

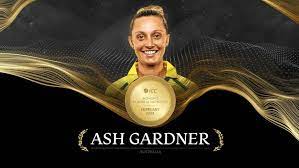

February 2023 Current Affairs Quiz

Micro ATMs, as the name suggests, are small ATMs or card-swipe machines that are portable and handheld. They also facilitate cardless money disbursal, using the Aadhaar-enabled payment system (AePS) at remote locations. According to the RBI, “The micro platform will enable function through low-cost devices (micro ATMs) that will be connected to banks across the country. This would enable a person to instantly deposit or withdraw funds regardless of the bank associated with a particular business correspondent (BC). This device will be based on a mobile phone connection and would be made available at every BC. Customers would just have to get their identity authenticated and withdraw or put money into their bank accounts.”

Meanwhile, cash withdrawals worth ₹19.67-lakh crore were done in December 2020. In December 2021, it was ₹25.2-lakh crore, and grew to only about ₹25.5-lakh crore by November 2022, when the number of micro ATMs stood at 13.3 lakh. This also means that the value of transactions per micro ATM per month is also going down. The cash withdrawal numbers for December are yet to be released.