Adjustment Mechanism Economics

- Fixed exchange rate system: Fixed or pegged exchange rate system refers to a system in which exchange rate of a country’s currency is fixed to another country’s currency or the price of gold by the government or the central bank. The basic purpose of adopting this system is to ensure stability in balance of payments. To achieve stability monetary authority buy foreign currency when the exchange rate becomes weaker and sell foreign currency when the exchange rate get stronger.

Under the gold standard, the currency in used was made a of gold or was convertible into gold at a fixed rate

A deficit or surplus in balance of payment was automatically adjusted under gold standard by the price specific flow mechanism. For instance a deficit in balance of payment meant a fall in the foreign exchange reserves of the country due to an outflow of gold to a surplus country. This reduce the country’s money supply thereby declining to price level. This in turn would increase the exports and reduce its imports. This adjustment process was supplemented by a rise in interest rate lead to inflow of short capital and restoring balance of payment equilibrium. Monetary authority may fixed the exchange rate by a intervention in the currency market. The fixed exchange rate system is explained with the help of a figure

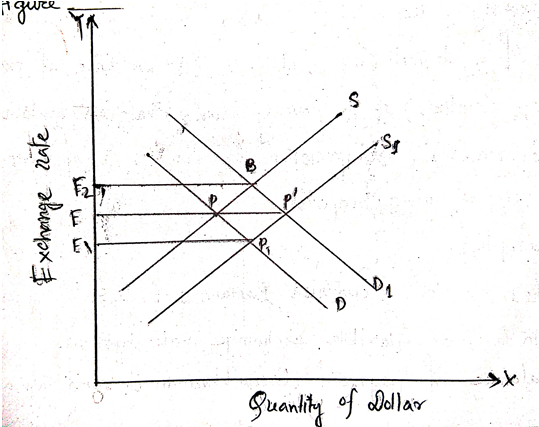

In the figure D and S are the demand and supply curve of dollar. They determined the exchange rate at point E which the authority maintains suppose the demand for dollars is more than their supply as shown in figure PP/ given the supply. This leads to rise in exchange rate to E2. To maintain the exchange rate at the fixed level E, the monetary authority will continue to supply dollars to the market tell the exchange rate E is reached. In the opposite case, if there is excess supply, PP/ in figure, given the demand, the exchange rate falls to E1. To maintain the exchange rate at E the monetary authority will start to buy dollars been the market till the exchange rate E is reached.

- Flexible exchange rate system: The disequilibrium in balance of payment under flexible exchange rate is automatically solved by the forces of demand and supply for foreign exchange. This is automatically achieved by a depreciation (or appreciation) of a country’s currency in case of a deficit (or surplus) in its balance of payment. Depreciation (or appreciation) of a country means that its relative value decreases (or increase). Depreciation has the effect of encouraging exports and discouraging imports.

(i) There are two countries Britain and U.S

(ii) Both are flexible exchange rate system.

(iii) Balance of payment disequilibrium is automatically adjusted by changes in exchange rate.

(iv) Prices are flexible in both the countries.

(v) There is free trade between the two countries.

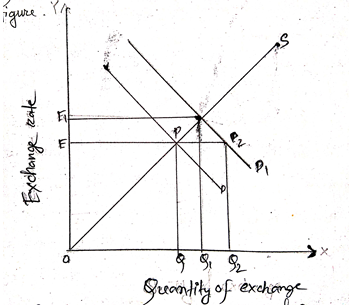

Given this assumption the adjustment process is explained with the help of a figure

This means an increase in US demand for british pound. The implies depreciation of the U.S. dollar and appreciation of the british pound. As a result import prices of import goods rise in the US and the prices of US exports fall. This leads to a new equilibrium point P1 and a new exchange rate OE1. The demand for foreign exchange equals the supply of foreign exchange at OQ1 and the balance of payments is in equilibrium.

On the other hand, the higher price of british goods in terms of dollars tends to reduce demand for british goods and increasing the demand for domestic goods in the U.S. This leads to the movement from P2 to P1 along the new demand curve D1. Thus, the initial deficit PP2 in balance of payment is removed by increased in the foreign exchange supplied QQ1 and decrease in the foreign exchange demanded by Q2Q1 so that balance of payment equilibrium is achieved at the exchange rate OE1 whereby OQ1 foreign exchange is supplied and demanded.